Rising inflationary pressures caused bond yields to rise sharply. Global equity markets sold off in response to higher bond yields and concerns related to the Russian invasion of Ukraine. Australian equities outperformed significantly, boosted by higher energy & commodity prices.

International Equities

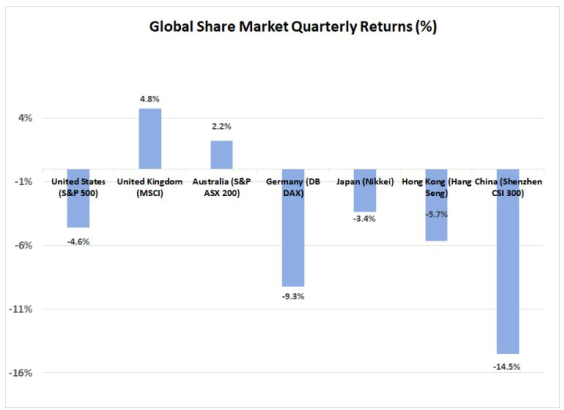

There was a wide disparity in performance across global equity markets last quarter. Nearly all major markets were sold down in January in response to higher bonds yields. However, some markets have bounced back strongly over recent weeks. Generally, those markets less impacted by the Russian-Ukraine crisis, and / or benefitting from surging commodity prices have rebounded the strongest.

Conversely, European markets, as well as those in economies with a heavy reliance on commodity imports, tended to underperform. Concerns over the impact of rising energy prices dominated sentiment in Europe, with the German market falling 9.3% over the quarter. In contrast, the UK market, with a higher energy company representation, is 4.8% higher.

In the United States, there was more focus on underlying economic growth fundamentals, which continued to be positive and evidenced by further declines in unemployment and jobless claims falling to their lowest level since 1969. Investors also took some comfort from comments by the Federal Reserve Bank Chairman suggesting that the chance of a recession was “not particularly elevated”, and that the economy was well placed to deal with higher interest rates. The US S&P 500 Index rose 3.6% in the month of March, but remains 4.6% lower for the quarter.

Despite some very strong performances from energy exporters, emerging markets overall finished in negative territory last quarter, largely due to continued declines on the Chinese market. With China being a large commodity importer, rising prices for energy and other raw materials is likely to be detrimental to the near term growth outlook for the economy. In addition, China continues to be impacted by COVID.

The nation’s relatively low levels of past communityexposure and vaccination has necessitated further lockdowns, including in its largest city of Shanghai. The Chinese market fell by 14.5% during the quarter. In addition, the Emerging Market Index has been impacted by events in Eastern Europe. Prior to being removed from the MSCI Index and closed in late February, the Russian market had dropped 36%. Other Eastern Europe markets have also performed poorly.

Infrastructure held up particularly well over the March quarter, with global listed infrastructure stocks gaining 7.3%. With revenues typically linked to inflation, these investments were well supported. The impact of higher expected inflation more than offset any concerns stemming from the effect of interest rate increases on these assets.

Australian Equities

The Australian equity market outperformed global averages significantly in the March quarter. Higher commodity prices were a key contributor, with both Energy (up29%) and Resources (up 20%) leading the market. These sectors were boosted by oil and iron ore prices, which both rallied just over 30% for thequarter. Increases in some base metal prices were even more significant, which benefited a range of smaller mining companies.

Financials were a beneficiary of rising bond yields. Higher interest rates provide scope for banks to widen interest margins and also generate increased earnings for insurance company savings pools.

Outside of financials, energy and resources, returns were generally negative. “Growth” orientated stocks were sold down heavily early in the quarter. One of the explanations for this trend was the ongoing rise in inflationary pressure (stemming from higher commodity prices) and the related increase in bond yields. These higher yields reduce the attractiveness of stocks reliant on earnings growth in future years. As a result, the Information Technology sector was the weakest performer with a decline of 14% for the quarter.

Fixed Interest & Currencies

Higher energy& commodity prices,combined with supply and labour constraints across various industries, have continued to push inflationary pressure shigher. Central banks around the globe are progressively tightening monetary policy as a result, with the Bank of England and the U.S Federal Reserve both lifting cash interest rates. With expectations of more increases to come, bond yields have continued to rise. The higher yields have resulted in falling prices for bonds, creating negative returns for fixed interest investors.

In the U.S.,10-year Treasury Bond yields jumped from 1.52% to 2.32% over the March quarter. Somewhat surprisingly given our lower inflation data, Australian yields increase more, with the 10-year bond jumping from 1.67% to 2.84%. Yield increases for shorter terms were even more significant, resulting in a “flattening” of the yield curve. Australia’s 3-year government bond yield jumped from 0.96% to 2.31% over the quarter. Stronger commodity prices and higher bond yields contributed to a rise in the $A last quarter. The $A rose US 2.3 cents to US 74.8 cents, with this increase extending the losses on global equity markets for those equity investors with unhedged currency exposures.

Important Information

The following indexes are used to report asset classperformance: ASX S&P 200 Index, MSCI World Index ex Australia net AUD TR (composite of 50% hedged and 50% unhedged), FTSE EPRA/NAREIT Developed REITs Index Net TRI AUD Hedged, Bloomberg AusBond Composite 0 Yr Index, Barclays GlobalAggregate ($A Hedged), Bloomberg AusBond Bank Bill Index, S&P ASX 300 A-REIT (Sector) TR Index AUD, S&P Global Infrastructure NR Index (AUD Hedged).

General Advice Disclaimer

This document has been prepared by Sage Advisers Pty Ltd (AFSL 238039). Any advice provided is of a general nature and does not take into account personal circumstances. Any decision to invest in products mentioned in this document should only be made after reviewing the relevant Product Disclosure Statements. Should the reader wish to avail of using the above investment philosophy they should only do so firstly seeking personal financial advice through a financial adviser. Past performance is not a reliable indicator of future performance.

Comments